Form Of Living Trust

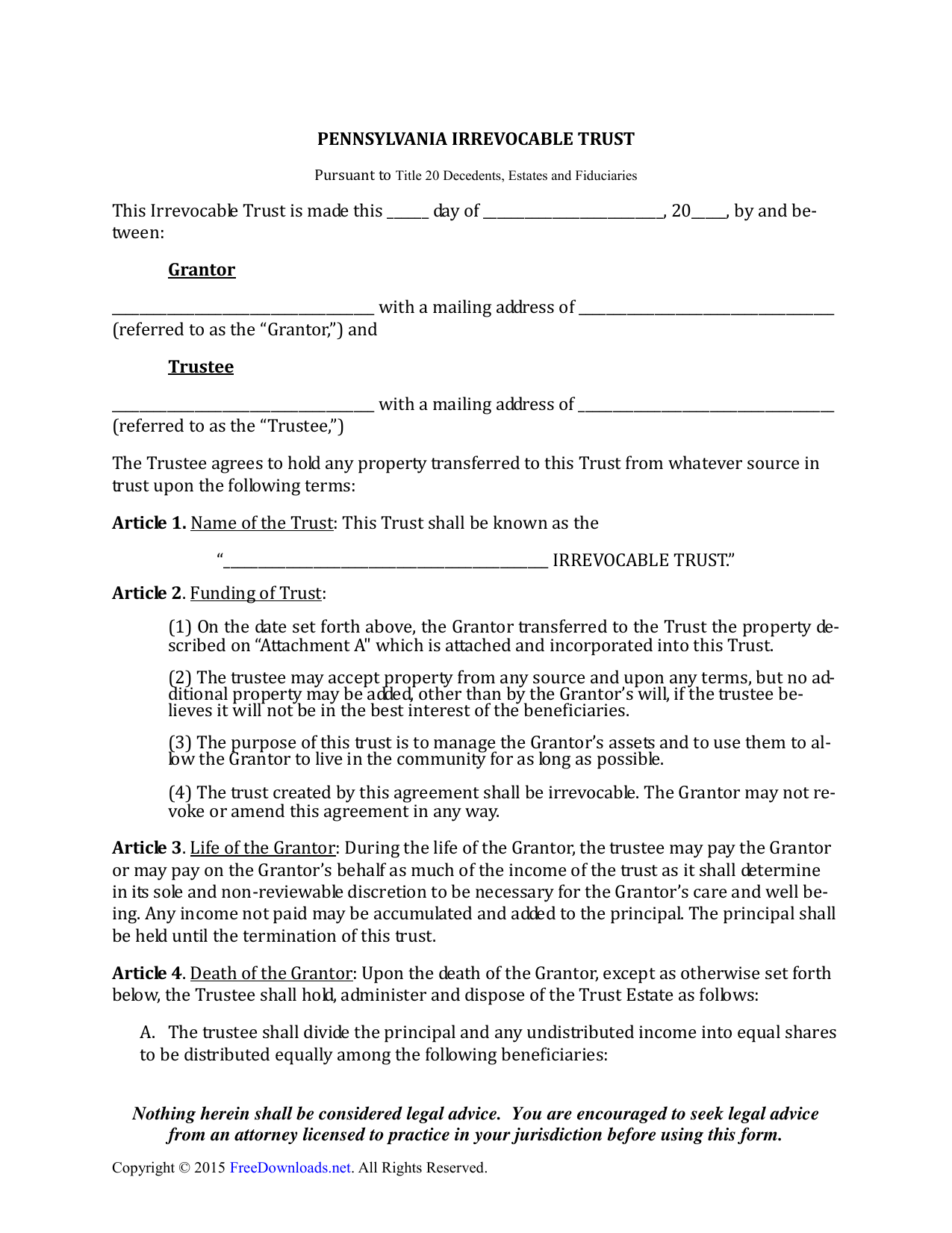

Unlike a will a trust does not go through the probate process with the court.

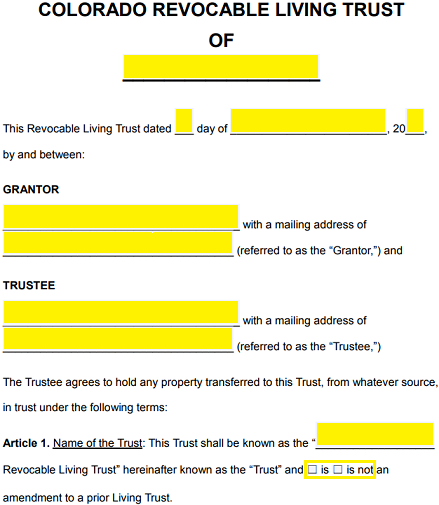

Form of living trust. Unlike a will this document is created during the course of the grantor s life and does not require probate to disperse the individual s possessions. In some states the probate proceedings associated with the distribution of assets as outlined in a standard will could take months. Living trust forms come in handy for the people who may have put all their assets into a trust or others who may be assisting them in this endeavor. Revocable living trust forms by state.

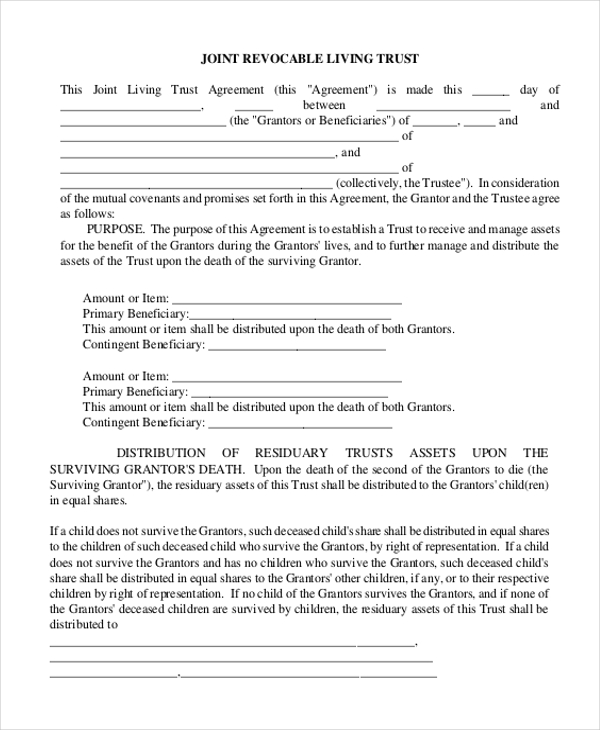

What are the benefits of using living trust forms. Revocation of trust forms by state. Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time of the grantor s death the beneficiary and the successor trustee are often the same person. Thus the target audience for these forms is.

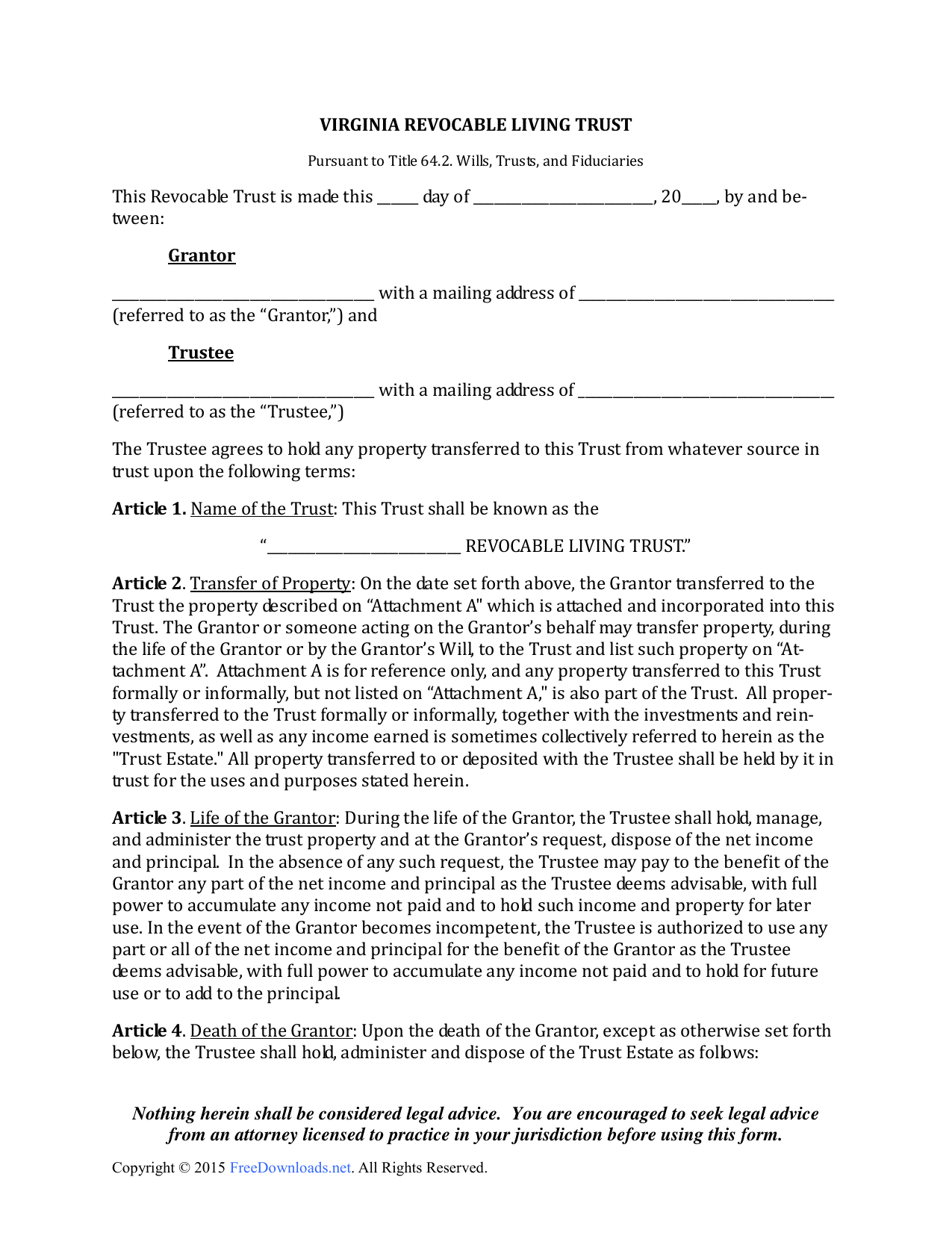

Living trusts avoid the probate proceedings and fees associated with wills. A living trust is a way for you to set aside funds for quicker distribution for caring for your minor children disabled family members or pets. Download a living trust also known as a inter vivos trust that allows an individual the grantor to gift assets and or property during the course of their life to another individual the beneficiary. A revocable trust allow the transfer of assets without probate yet they allow you to retain control of the assets during your lifetime.

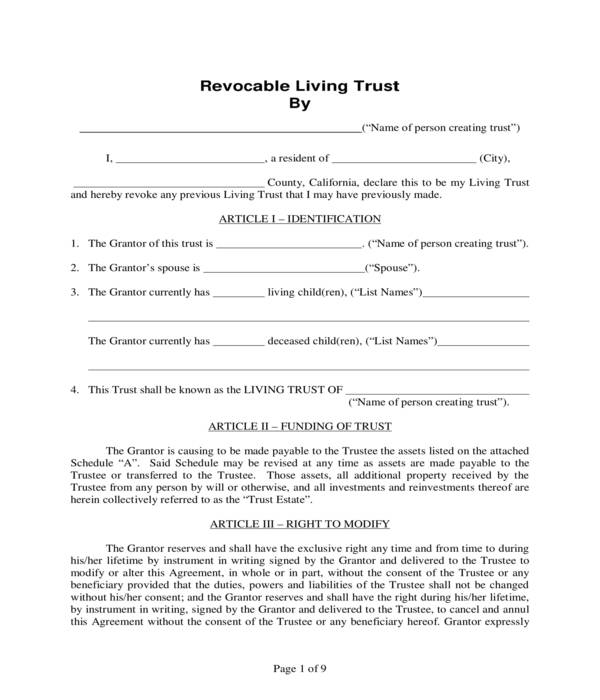

The trust then owns and manages the property held by the trust through a trustee for the benefit of the named. Revocation of living trust form. Living trust forms are used to prepare your estate. A revocable trust is flexible and can be dissolved at any time.

A revocable trust typically becomes. The trustee will be in charge of handling the property even though it belongs to the beneficiary. The grantor maintains ownership over their assets and they can make alterations to the document or choose to revoke the trust at any point in their lifetime. Although most living trusts include another entity or party there is one type of revocable living trust which identifies the property owner as the sole grantor and the trustee of the trust.

Assets can also be designated to support. A revocable living trust is created by an individual the grantor for the purpose of holding their assets and property and in order to dictate how said assets and property will be distributed upon the grantor s death. A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation. A living trust also known as a revocable trust is an agreement created by a person known as the grantor.

This form is the revocable living trusts declaration form which is specifically for declaring and affirming that the property is owned by the grantor. A living trust is a trust established during a person s lifetime in which a person s assets and property are placed within the trust usually for the purpose of estate planning. The grantor may appoint themselves trustee manager of the trust but must also appoint a successor trustee in case.